Introduction

Background on India’s Labor Market

India’s labor market is one of the largest in the world, encompassing over 500 million workers across formal and informal sectors. The nation has witnessed a paradigm shift from its agrarian roots to a service‐driven economy, with information technology, finance, and business services leading growth. Yet, despite significant advances, unemployment in India remains a pressing challenge. In recent years, the unemployment in India narrative has taken center stage, driven by macroeconomic headwinds, skill mismatches, and demographic pressures.

Defining Unemployment and Its Measurement

Unemployment is defined as the condition where individuals who are actively seeking work remain jobless. The primary measurements used in India include:

Unemployment Rate (UR): Percentage of the labor force that is unemployed and actively seeking employment.

Worker Population Ratio (WPR): Percentage of a region’s working‐age population engaged in gainful employment.

Labor Force Participation Rate (LFPR): Percentage of working-age individuals who are active in the labor market (either employed or looking for work).

Government agencies such as the Periodic Labour Force Survey (PLFS) and the Centre for Monitoring Indian Economy (CMIE) provide quarterly and annual updates on these metrics. Understanding these measurements is crucial to grasp how “unemployment increases in India” truly impacts multiple socio‐economic dimensions.

Historical Trends of Unemployment in India

Pre‐2020 Context: Steady Decline or Fluctuation?

Post‐Global Financial Crisis Recovery (2009–2019)

When the 2008 global financial crisis shook economies worldwide, India’s diverse domestic market and robust service sector helped cushion the blow. From 2009 to around 2016, the unemployment rate hovered between 4.0% and 5.5%, with minor fluctuations. During this period, rapid expansions in IT and manufacturing (driven by the “Make in India” initiative) created millions of jobs. However, these gains were often offset by insufficient formal sector absorption of low‐skilled labor.

Early Signs of Instability

By 2017–2018, survey data indicated subtle signs of distress: the unemployment rate began inching above 6.0%. The demonetization exercise (November 2016) and implementation of the Goods and Services Tax (July 2017) introduced short‐term pains in small and medium enterprises (SMEs), which are key employment drivers. Although many businesses adapted, unemployment trends underscored structural rigidity and a lack of scalable job creation, foreshadowing future vulnerabilities.

2020 Onwards: Pandemic‐Driven Shock

Lockdown Effects on Employment

The abrupt lockdowns imposed in March 2020 to curb COVID‐19 infections led to an unprecedented contraction. Unemployment in India spiked to nearly 23.5% in April 2020 (according to CMIE weekly reports), reflecting the mass exodus of migrant workers, suspension of non‐essential businesses, and collapse of informal sector livelihoods. Although urban white‐collar jobs in IT and finance pivoted to remote models, the informal economy—with over 90% of total workforce—was severely disrupted.

Informal Sector Disruptions

The informal sector, which employs approximately 400 million Indians, faced cascading effects. Daily wage workers in construction, textiles, hospitality, and retail lost incomes immediately. Many returned to their villages, causing reverse migration waves. This shift reintroduced labor into already saturated rural areas, exacerbating unemployment in rural India and straining agrarian livelihoods.

Recent Data and Statistics (2024–2025)

National Unemployment Rate

As of April 2025, India’s national unemployment rate is estimated at 5.1%, up from 4.4% in April 2024. Though still below the pandemic peak, this uptick signals increasing joblessness across sectors. The rise is partly attributed to a combination of slowed GDP growth (projected at 6.2% for FY25), global supply chain disruptions, and domestic policy uncertainties.

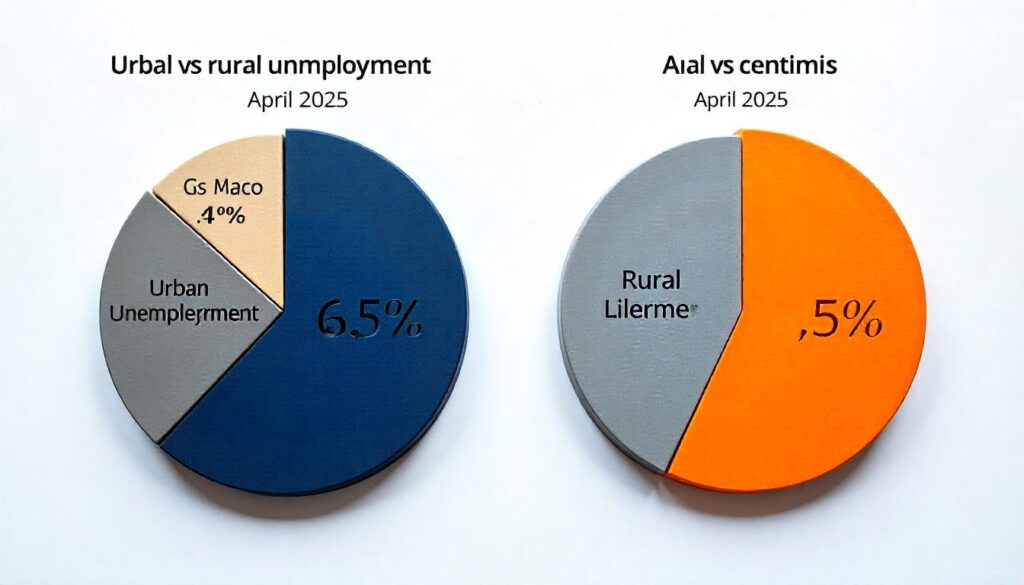

Urban vs. Rural Unemployment in India

Urban Unemployment Rate: 6.5% (April 2025)

Rural Unemployment Rate: 4.5% (April 2025)

Urban centers, traditionally engines of white‐collar and skilled work, have seen a resurgence in unemployment due to retrenchment in manufacturing (especially export‐oriented units) and a slowdown in construction. Meanwhile, rural areas—despite improved MGNREGA payouts—remain vulnerable to seasonal agricultural cycles, leading to spikes in unemployment in rural India during off‐seasons.

Youth Unemployment in India

One of the most alarming statistics is the youth unemployment rate, which has climbed to 16.1% for ages 15–29 (Q3 FY25). This demographic bulge (over 600 million under 25) has rising educational attainment but faces severe skill mismatches. Graduates often find available jobs either below their qualification level or requiring skills they lack. As a result, “graduates with no jobs” has emerged as a common narrative

Gender Disparities and Regional Variations

State‐wise Unemployment Statistics

Highest Unemployment States (April 2025): Punjab (8.2%), Tamil Nadu (7.9%), Haryana (7.5%)

Lowest Unemployment States: Bihar (3.2%), Odisha (3.5%), Uttar Pradesh (3.8%)

Southern states—once lauded for high literacy and industrialization—are now grappling with slower job creation, while some eastern states show lower unemployment due to agricultural absorption, though quality of employment remains low.

Sectoral Breakdowns (Agriculture, Manufacturing, Services)

Agriculture: 30% of workforce; nominal unemployment of 3.8% in April 2025 (seasonal factors).

Manufacturing: 15% of workforce; unemployment at 7.2% due to factory closures and automation.

Services: 55% of workforce; 5.5% unemployed, with declines in hospitality, travel, and retail offset partially by IT, telecom, and e‐commerce growth.

The services sector has traditionally buffered unemployment pressures, but uneven growth across sub‐segments exacerbates disparities.

Key Causes of Rising Unemployment in India

Economic Slowdown and GDP Growth Deceleration

India’s GDP growth decelerated from 8.7% in FY22 to an estimated 6.2% in FY25. Lower capital expenditure, global trade tensions, and slower consumer demand hamper job creation. When GDP growth dips below 7%, India historically struggles to generate adequate jobs for its expanding workforce. Businesses delay hiring, freeze recruitment, or resort to contract labor, which often falls outside official unemployment measures but reflects underemployment and income insecurity.

Skill Mismatch and Education Gaps

Though India produces 15 million graduates annually, only 12% possess the skills demanded by modern industries (NASSCOM, 2024). Many curricula remain theoretical, lacking hands‐on training or industry alignment. As a result, even job openings in manufacturing or BPOs remain unfilled due to incompatibility between academic outputs and employer requirements. Consequently, skill development programs in India have proliferated, yet face challenges of quality, reach, and coordination.

Technological Automation and Structural Shifts

Automation, robotics, and AI have accelerated job displacement in sectors such as textiles, call centers, and entry‐level data processing. As companies invest in technology to reduce costs, low‐skilled roles are automated. Without adequate retraining or reskilling, workers displaced by machines struggle to find alternative livelihoods, fueling unemployment in urban India.

Population Growth vs. Job Creation Lag

India’s working‐age population (15–59 years) grew by over 25 million between 2021 and 2025, but net job creation numbers average at 8–10 million per year—insufficient to absorb new entrants. This gap leads to a “youth bulge” scenario where first‐time jobseekers face intense competition for limited openings. The situation is aggravated when families move from rural to urban areas seeking better opportunities, swelling urban labor pools.

Policy and Regulatory Bottlenecks

Despite reforms like the Insolvency and Bankruptcy Code (IBC), Ease of Doing Business improvements, and GST rationalization, investment inflows remain suboptimal. Complex labor laws, land acquisition hurdles, and bureaucratic delays deter entrepreneurs from scaling businesses that could create large‐scale employment. Additionally, infrastructure deficits (power, transport, logistics) raise operational costs, reducing firms’ hiring capacities.

Impact of Unemployment on the Indian Economy

Decline in Household Income and Consumption

When primary earners lose jobs, household incomes shrink, leading to decreased consumer spending. According to the National Statistical Office (NSO), consumption expenditure declined by 4.5% in rural areas and 3.2% in urban centers in FY25, directly correlated with rising joblessness. Lower consumption slows growth further, creating a vicious cycle of reduced demand and constrained employment.

Increase in Poverty Rates and Inequality

The World Bank estimates that every 1% increase in the unemployment rate translates to a 0.7% rise in poverty headcount. In Eastern Uttar Pradesh and Bihar, where poverty rates already exceed 30%, surging joblessness pushes more families below the poverty line. Economic inequality widens as salaried and formal workers maintain relative stability, while informal sector laborers, with minimal social security, bear the brunt of income losses.

Social Consequences (Crime, Migration, Mental Health)

High unemployment correlates with increased crime rates in urban slums, as marginalized youth resort to petty theft or illegal activities to survive. Simultaneously, internal migration rises: states like Bihar, Jharkhand, and Odisha report annual outflows of 1.2 million rural workers to Maharashtra, Gujarat, and Kerala. Migrant workers face precarious living conditions, and their families left behind confront psychological distress. The Lancet (2024) links a 12% surge in mental health issues—including depression and anxiety—to prolonged unemployment, especially among young males.

Fiscal Pressures on Government (Welfare, Subsidies)

As unemployment rises, governments allocate larger budgets to welfare schemes (MGNREGA payouts increased by 15% in FY25) and food subsidies. Combined with lower tax revenues due to depressed incomes and corporate profits, fiscal deficits balloon. The 2024–25 Interim Budget reported a revenue shortfall of ₹1.2 lakh crore, prompting borrowing and delaying infrastructure projects critical for job creation.

Future Outlook: Projections and Mitigation Strategies

Projected Unemployment Trends by 2030

According to the Ministry of Labour and Employment’s projections (2024):

Unemployment rate could stabilize at 5.5% in 2026–27, with gradual decline to 5.0% by 2030 if GDP growth sustains above 7%.

Youth unemployment may remain between 12–14% unless aggressive skilling and entrepreneurship programs are scaled.

Urban unemployment could edge higher (6.8%) unless balanced growth in Tier‐II and Tier‐III cities creates alternative job hubs.

Potential Growth Sectors and Job Engines

Green Energy and Climate‐Resilient Industries: Solar, wind, and waste‐to‐energy projects may generate 2 million jobs by 2030.

Digital Economy: E‐commerce, fintech, and digital content creation could absorb 4 million youth annually if digital infrastructure expands.

Healthcare and Wellness: Aging population and rising health expenditures suggest 3 million new roles in allied health and social care.

Tourism and Hospitality Revival: Domestic tourism post-COVID rebound could create 1.5 million jobs in hospitality, guided tours, and allied segments.

Policy Recommendations and Economic Reforms

Enhance Ease of Doing Business for MSMEs: Simplify credit access, streamline licensing, and offer tax incentives to boost job creation.

Focused Rural Industrialization: Establish agro‐based clusters and food processing units in rural areas to reduce migration and strengthen unemployment in rural India.

Education‐Industry Linkages: Mandate industry internships as part of college curricula; incentivize companies to co‐develop syllabi.

Land and Labor Reform: Rationalize archaic labor laws (e.g., simplify contract labor regulations) to encourage formal sector hiring without compromising worker rights.

Digital Infrastructure Expansion: High-speed internet in remote areas to enable remote work and digital entrepreneurship, thereby easing urban job pressures.

Conclusion

Unemployment in India has surged from pre-pandemic lows to around 5.1% as of April 2025, reflecting multiple interlocking challenges: economic deceleration, skill mismatches, structural shifts, and policy lags. The crisis is especially acute among youth, where nearly 16.1% remain jobless despite rising educational attainment. Urban centers, which once promised abundant opportunities, now wrestle with retrenchments in manufacturing and service sectors. Rural areas continue to face seasonal underemployment, underscoring the need for diversified income sources beyond agriculture.

Government interventions—ranging from MGNREGA and PMRY to Skill India Mission—have provided crucial relief and pathways for skill enhancement, yet gaps in execution, quality, and outreach persist. To reverse the troubling trend of unemployment in India, coordinated efforts are essential: aligning education with industry needs, bolstering MSMEs, and leveraging digital technologies to unlock new job avenues. As India strives to become a $5 trillion economy, ensuring that its burgeoning workforce has gainful, dignified employment will be the ultimate litmus test of inclusive growth.